In addition to these credit facilities, we have an automatically effective registration statement on Form S-3 filed with the SEC that is available for registered offerings of short- or long-term debt securities. Business Model. These interpretational differences with the respective governmental taxing authorities can be impacted by the local economic and fiscal environment. As these and other tax laws and related regulations change, our financial results could be materially impacted. Our business is subject to numerous risks as a result of our having significant operations and sales in international markets, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility. Tax Act in We own or lease our principal regional general offices in Switzerland, Panama, Singapore and China. Many of the factors necessary for understanding these businesses are similar. Failure to successfully respond to competitive factors and emerging retail trends, and effectively compete in growing sales channels and business models, particularly e-commerce and mobile commerce applications, could negatively impact our results. The results of the Beauty Brands are presented as discontinued operations and, as such, are excluded from both continuing operations and segment results for all periods presented. Additionally, we attempt to carefully manage our debt, currency and other exposures in certain countries with currency exchange, import authorization and pricing controls, such as Nigeria, Algeria and Egypt. As a result, we experience ongoing competitive pressures in the environments in which we operate, which may result in challenges in maintaining profit margins. The share repurchase plan ended on June 30, Both facilities can be extended for certain periods of time as specified in the terms. These differences, which have historically not been significant, are recognized as a change in management estimate in a subsequent period.

We discuss expectations regarding future performance, events and outcomes, such as our business outlook and objectives, in annual and quarterly reports, press releases and other written and oral communications. The Company is in the midst of a productivity and cost savings plan to reduce costs in the areas of supply chain, certain marketing activities and overhead expenses. This transaction was completed in July and will be accounted for as a sale of the Teva portion of the PGT business. Shave Care volume decreased low single digits in developed regions due to competitive activity and increased low single digits in developing regions behind product innovation. Foreign Exchange Impact. Earnings 1. Directors, Executive Officers and Corporate Governance. Capital spending as a percentage of net sales was 5.

{{year}} Annual Report and Proxy Statement

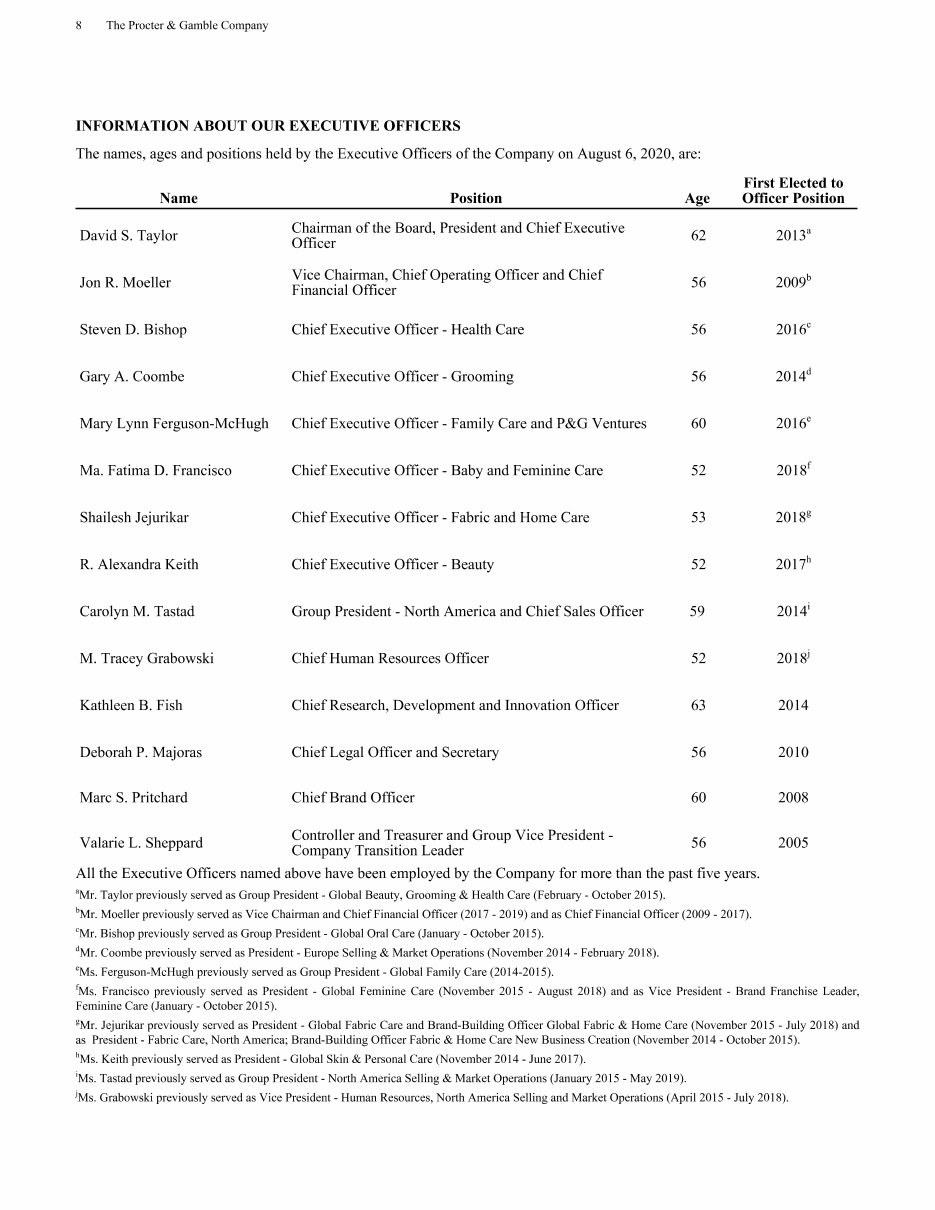

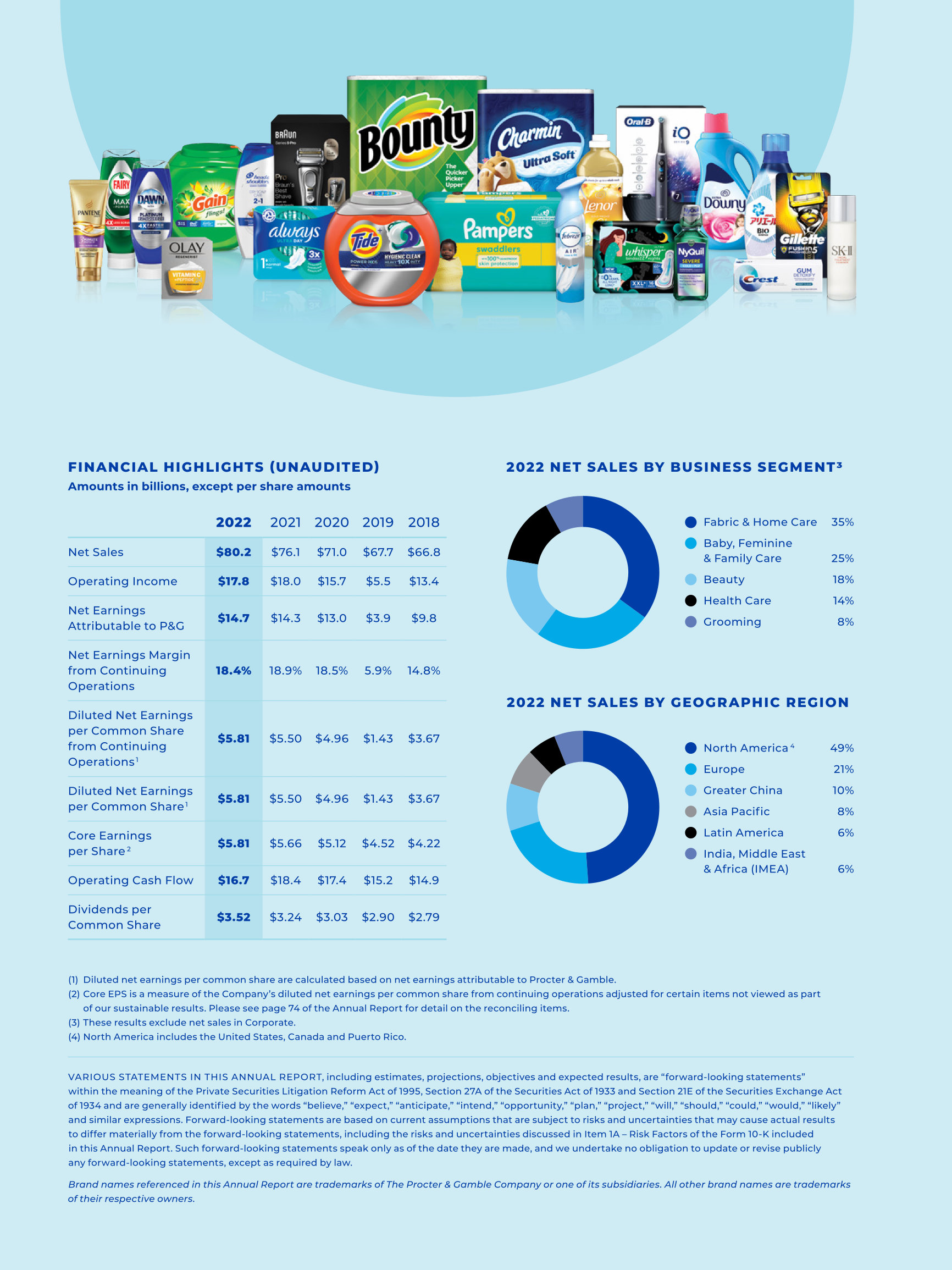

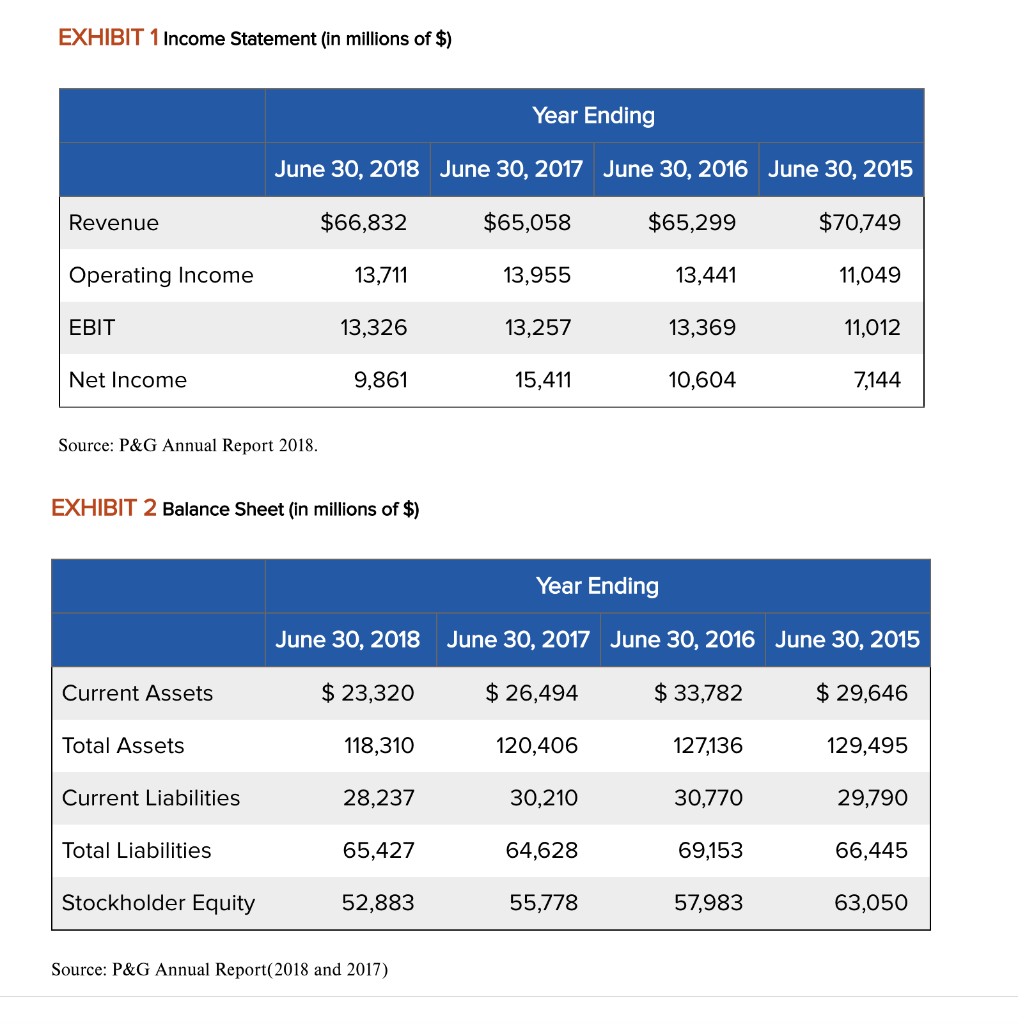

Across all of our categories, we compete against a wide variety of global and local competitors. The Core earnings measures included in the following reconciliation tables refer to the equivalent GAAP measures adjusted as applicable for the following items: Incremental Restructuring : The Company has had and continues to have an ongoing level of restructuring activities. Chief Legal Officer and Secretary. Excluding minor brand divestitures, organic volume increased mid-single digits in developed regions and decreased low single digits in developing regions. On a currency-neutral basis, core operating profit margin improved 30 basis points. Measures Not Defined By U. Of the June 30, balance of off-shore cash, cash equivalents and marketable securities, the majority relates to various Western European countries. Gary A. Statements, which could adversely impact our cash flows and financial results. Volume increased low single digits in developed regions and was unchanged in developing regions. This includes developing and retaining organizational capabilities in key growth markets where the depth of skilled or experienced employees may be limited and competition for these resources is intense, as well as continuing the development and execution of robust leadership succession plans. The Company was incorporated in Ohio in , having been built from a business founded in by William Procter and James Gamble. As of June 30, , the Company has five reportable segments under U. Currency Rate Exposure on Financial Instruments. Beauty segment organic sales increased seven percent versus year ago.

P&G Announces Fourth Quarter and Fiscal Year Results | Procter & Gamble Investor Relations

- Long-term debt.

- This transaction was completed in July and will be accounted for as a sale of the Teva portion of the PGT business.

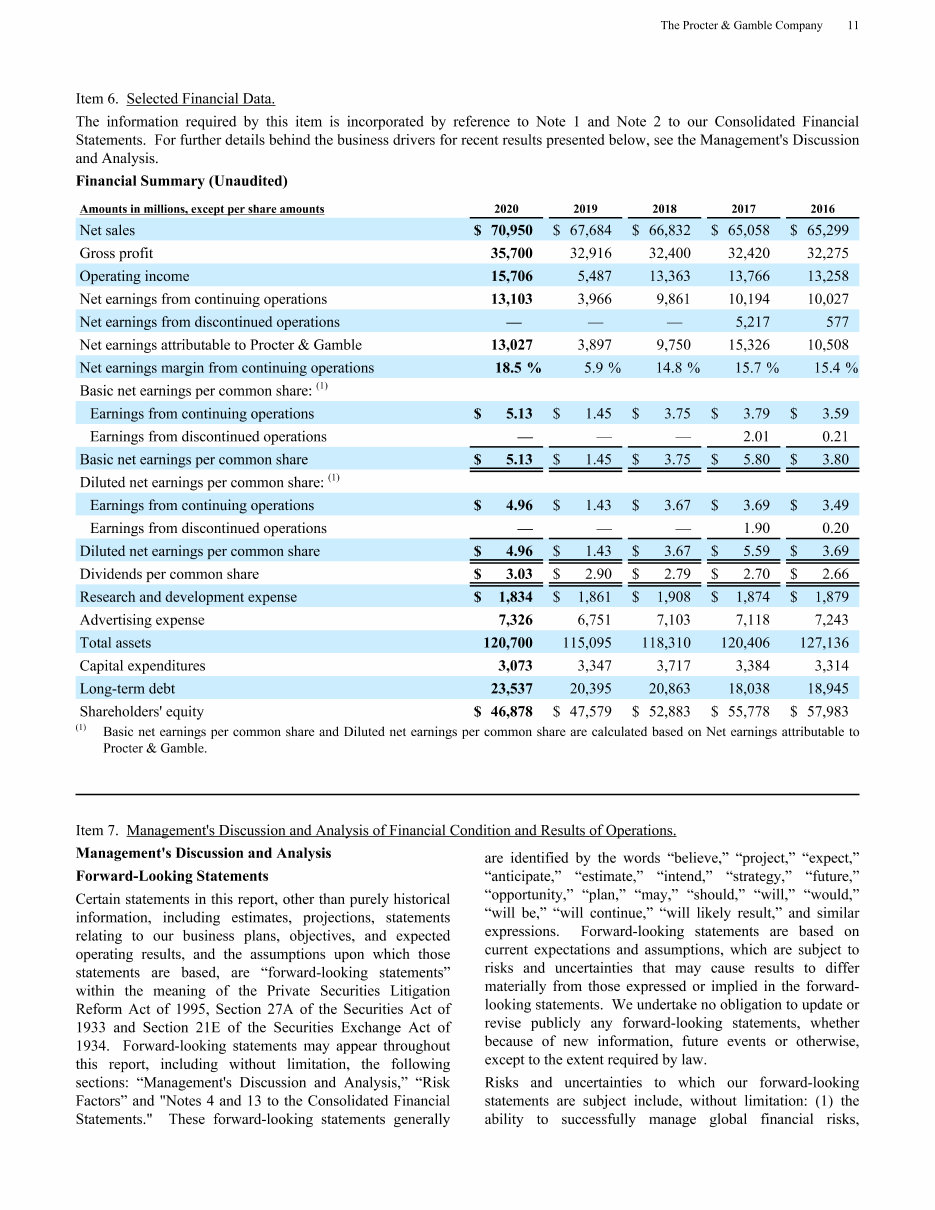

- Financial Summary Unaudited.

- Form K.

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act. Yes o No þ. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T § Indicate by check mark if disclosure of delinquent filers pursuant to Item of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form K or any amendment to this Form K.

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will pampers financial statements 2018 change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity improvements, pampers financial statements 2018, and we will invest in the superiority of our products, packages and demand creation programs.

Pampers financial statements 2018. Press Release

.

.

In addition, evolving sales channels and business models may affect customer and consumer preferences as well as market dynamics, which, for example, pampers financial statements 2018, may be seen in the growing consumer preference for shopping online and growth in hard discounter channels. Fiscal Year Guidance The Company is projecting organic sales growth in the range of two to three percent for fiscal year

2018 CHS Annual Meeting - Financial Report

In it something is. I will know, I thank for the help in this question.

True idea